AleaSoft, March 22, 2021. In the third week of March, the prices of most European electricity markets rose, while MIBEL made the difference with a price drop that placed it at the lowest price on the continent for most of the week. The variations in wind energy production and demand largely justify this behaviour. The wind energy production increased and the demand fell in the Iberian market, unlike the other markets. The CO2 futures set a historical record approaching €43/t.

Photovoltaic and solar thermal energy production and wind energy production

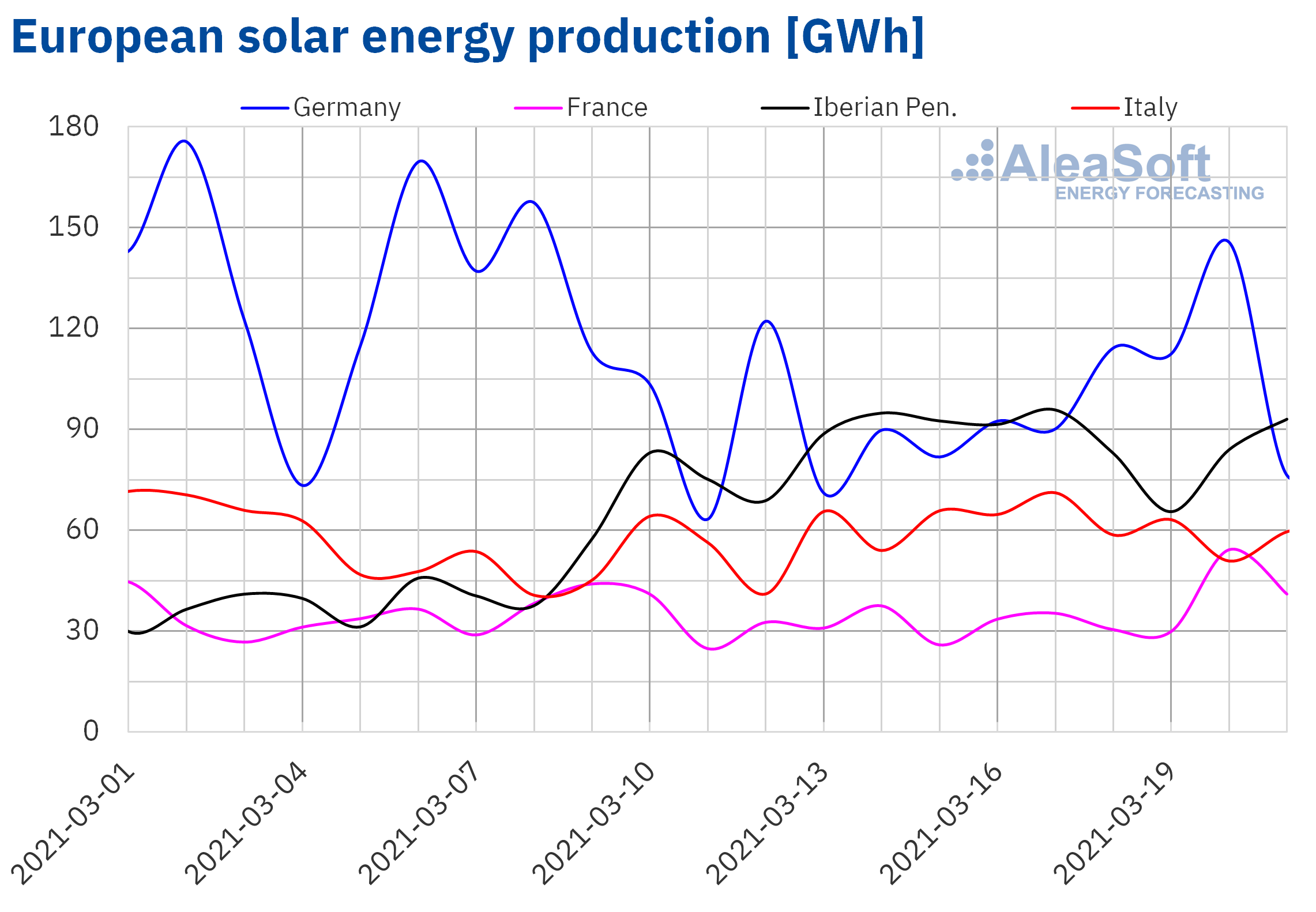

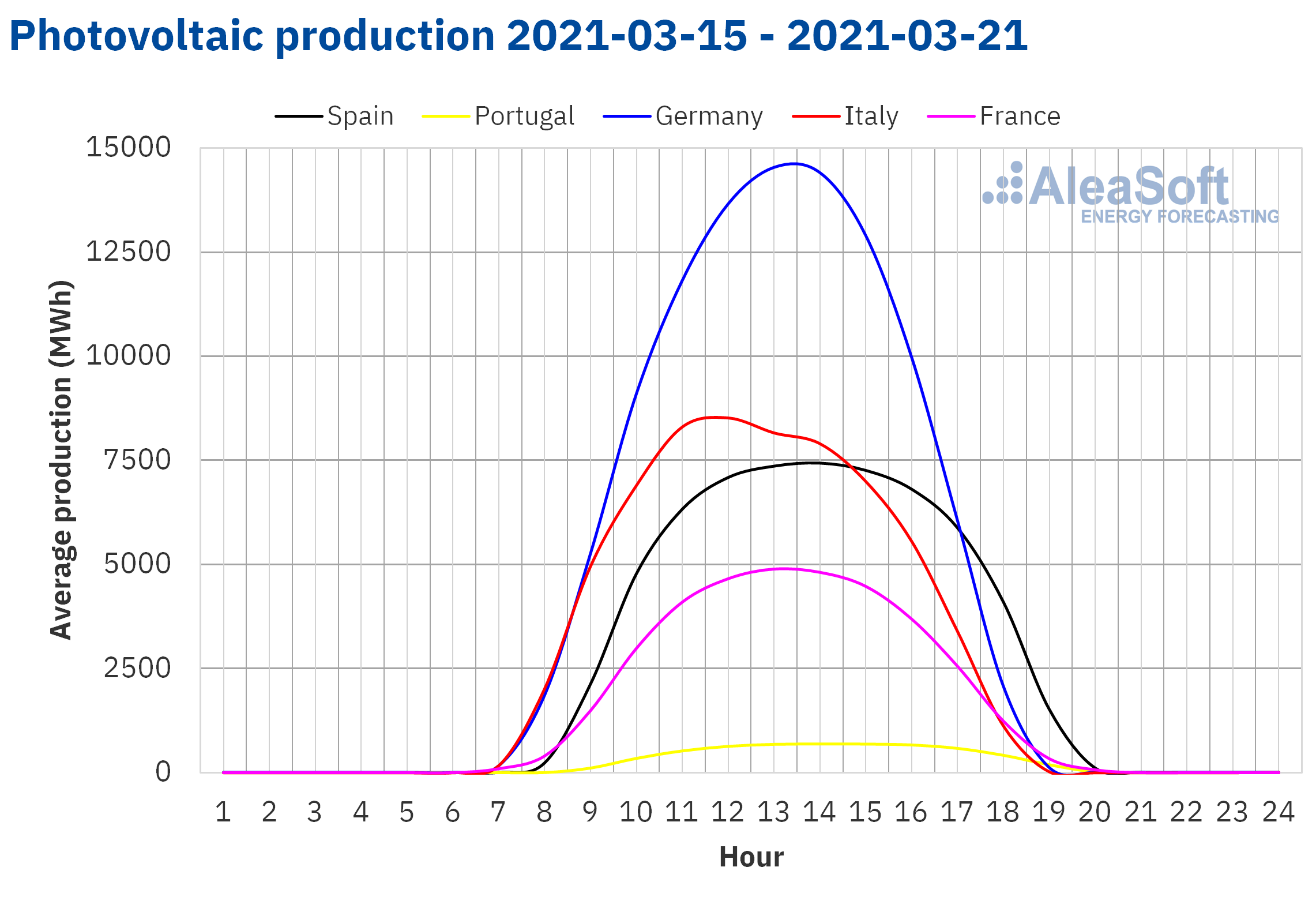

The solar energy production during the week that began on March 15 increased by 20% in the Iberian Peninsula and 18% in the Italian market compared to the previous week. On the other hand, in the markets of Germany and France it remained with little variation.

For the week of March 22, the AleaSoft‘s solar energy production forecasting indicates that it will decrease in the Spanish market. On the contrary, an increase in production is expected in the markets of Italy and Germany.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

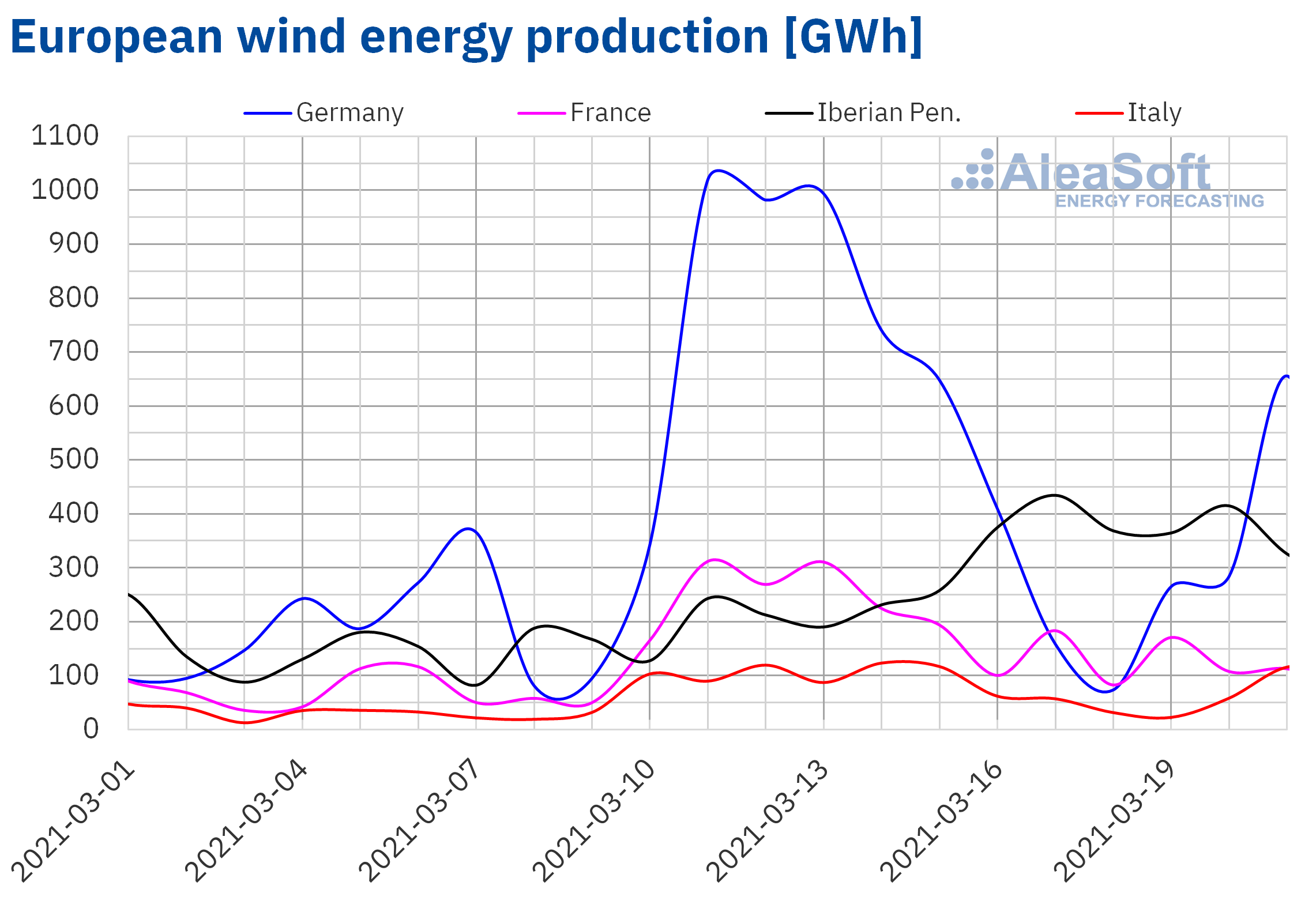

During the third week of March, the wind energy production increased by 87% in the Iberian Peninsula compared to the second week of the month. On the contrary, in the markets of Germany, France and Italy it decreased between 41% and 19%.

For the fourth week of March, the AleaSoft‘s wind energy production forecasting indicates that the production with this technology will be lower than that registered the previous week in all the markets analysed at AleaSoft, except in the German market, where little variation is expected.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

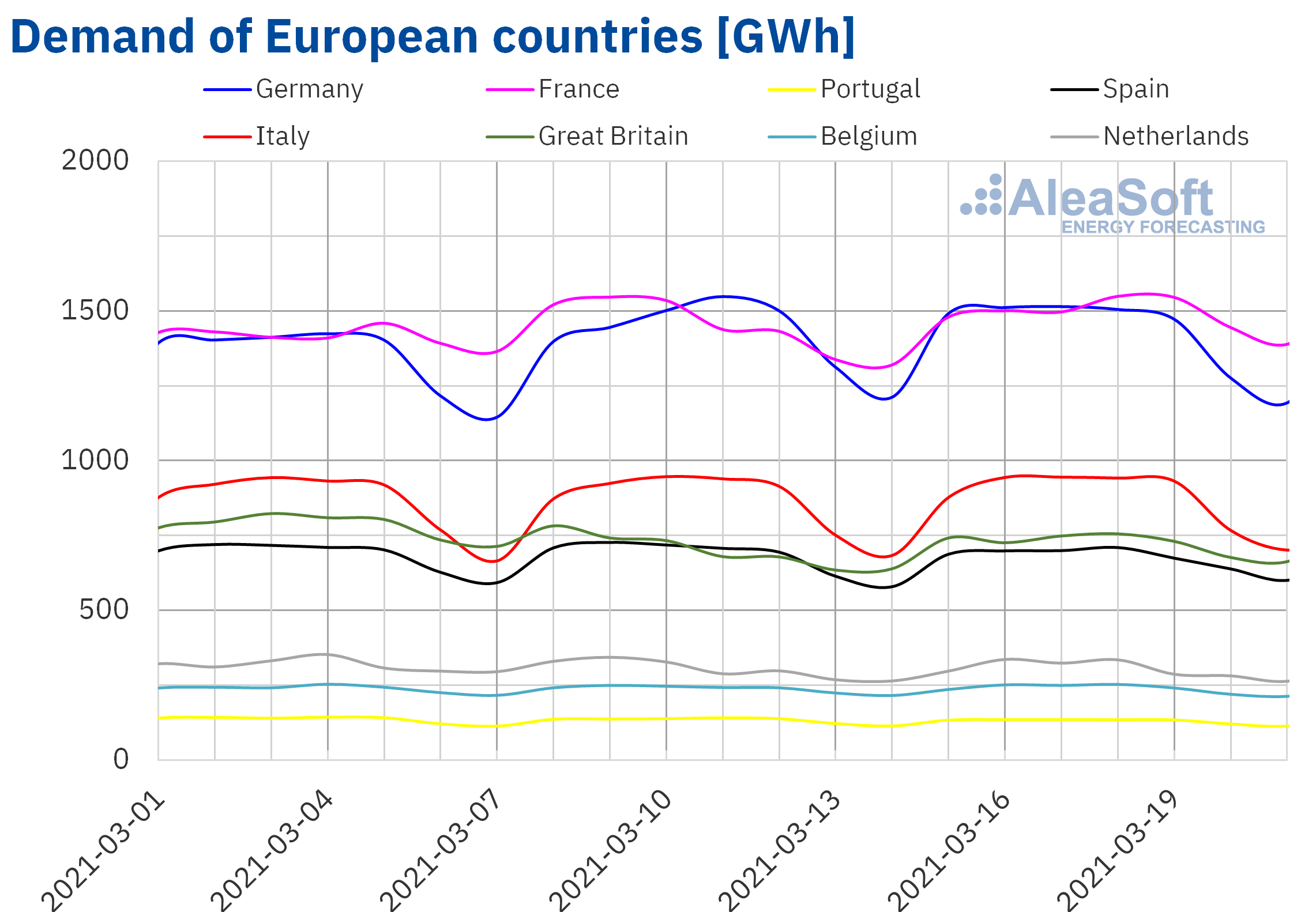

In the week of March 15, the electricity demand increased in most of the electricity markets of Europe compared to the previous week. The increases were lower than 3.0% in all markets, except in Great Britain, where there was an increase of 3.1%. On the other hand, in the markets of Portugal and Spain there were decreases, also below 3.0%.

The demand of most European markets is expected to decrease during the week of March 22, according to the AleaSoft‘s demand forecasting.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

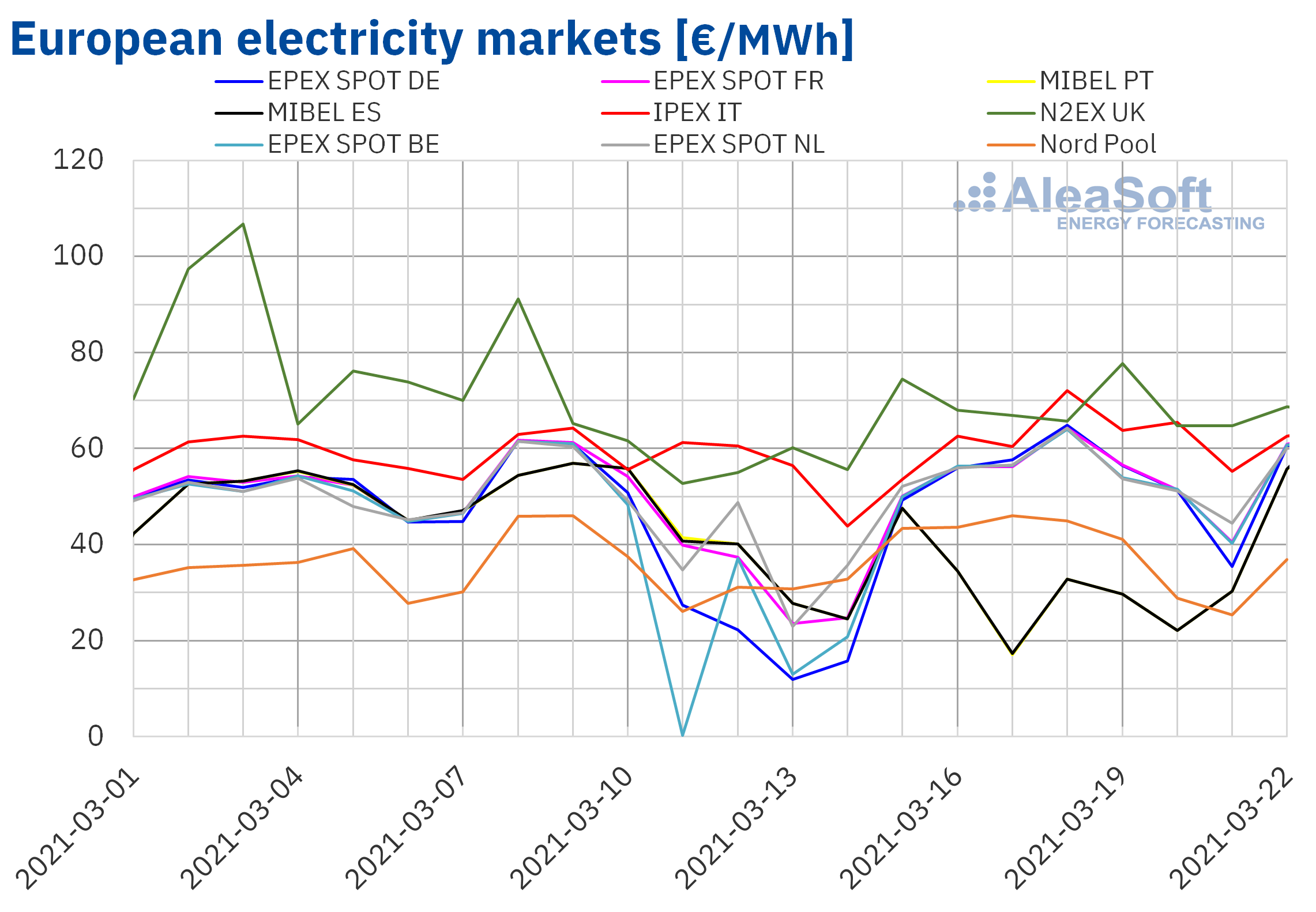

European electricity markets

The week of March 15, the prices of almost all the European electricity markets analysed at AleaSoft increased compared to those of the previous week. The exception was the MIBEL market of Spain and Portugal, with a decrease of 29%. On the other hand, the largest price increase, of 54%, was that of the EPEX SPOT market of Belgium, followed by that of the EPEX SPOT market of Germany, of 48%. On the contrary, the lowest price increase, of 6.9%, was that of the IPEX market of Italy. In the rest of the markets, the price increases were between 9.2% of the N2EX market of UK and the Nord Pool market of the Nordic countries and 24% of the EPEX SPOT market of France.

In the third week of March, the highest weekly average price was that of the N2EX market, of €68.87/MWh, followed by that of the Italian market, of €61.87/MWh. While the lowest averages were those of the Portuguese, Spanish and Nordic markets, of €30.59/MWh, €30.62/MWh and €39.04/MWh respectively. In the rest of the markets, the prices were between €53.00/MWh of the German market and €54.01/MWh of the market of the Netherlands.

On the other hand, almost the entire third week of March, the lowest daily prices in Europe were registered in the MIBEL market. The lowest price, of €17.12/MWh, was reached on Wednesday, March 17, in the Portuguese market. However, on Sunday, March 21, the lowest daily price was that of the Nord Pool market, of €25.40/MWh. This price was the lowest in the Nordic market so far this year.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

During the third week of March, the decline in wind energy production in most of the European continent and the recovery in demand favoured the increase in prices in most of the European electricity markets. The high CO2 prices also led to this increase. However, the significant increase in wind and solar renewable energy production in the Iberian Peninsula, as well as a slight decrease in demand, allowed the prices to fall in the MIBEL market.

The AleaSoft‘s price forecasting indicates that, due to the fall in European wind energy production, the week of March 22 there will be price increases in most European markets, which will be especially significant in the Iberian market.

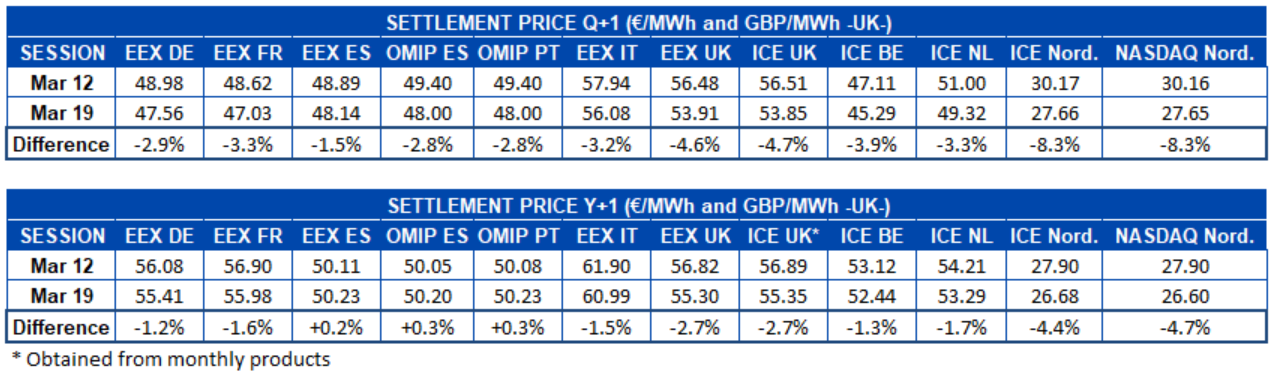

Electricity futures

The electricity futures prices for the following quarter registered a downward behaviour in all the European markets analysed at AleaSoft, if the settlement prices of the sessions of March 12 and 19 are compared. As usual, the ICE and NASDAQ markets of the Nordic region led the declines, with a decrease of 8.3% in both cases. The EEX market of Spain was the one with the lowest variation in its prices, of ‑€1.5/MWh.

Regarding the electricity futures prices for the next year 2022, the behaviour of the markets was more heterogeneous. While in the rest of Europe the prices fell, in the Iberian Peninsula there were increases. The OMIP market of Spain and Portugal had a growth of 0.3% in the prices of both countries and the EEX market of Spain also marked increases, in this case of 0.2%. In the rest of the markets, the decreases were between 1.2% of the EEX market of Germany and 4.7% of the NASDAQ market of the Nordic countries.

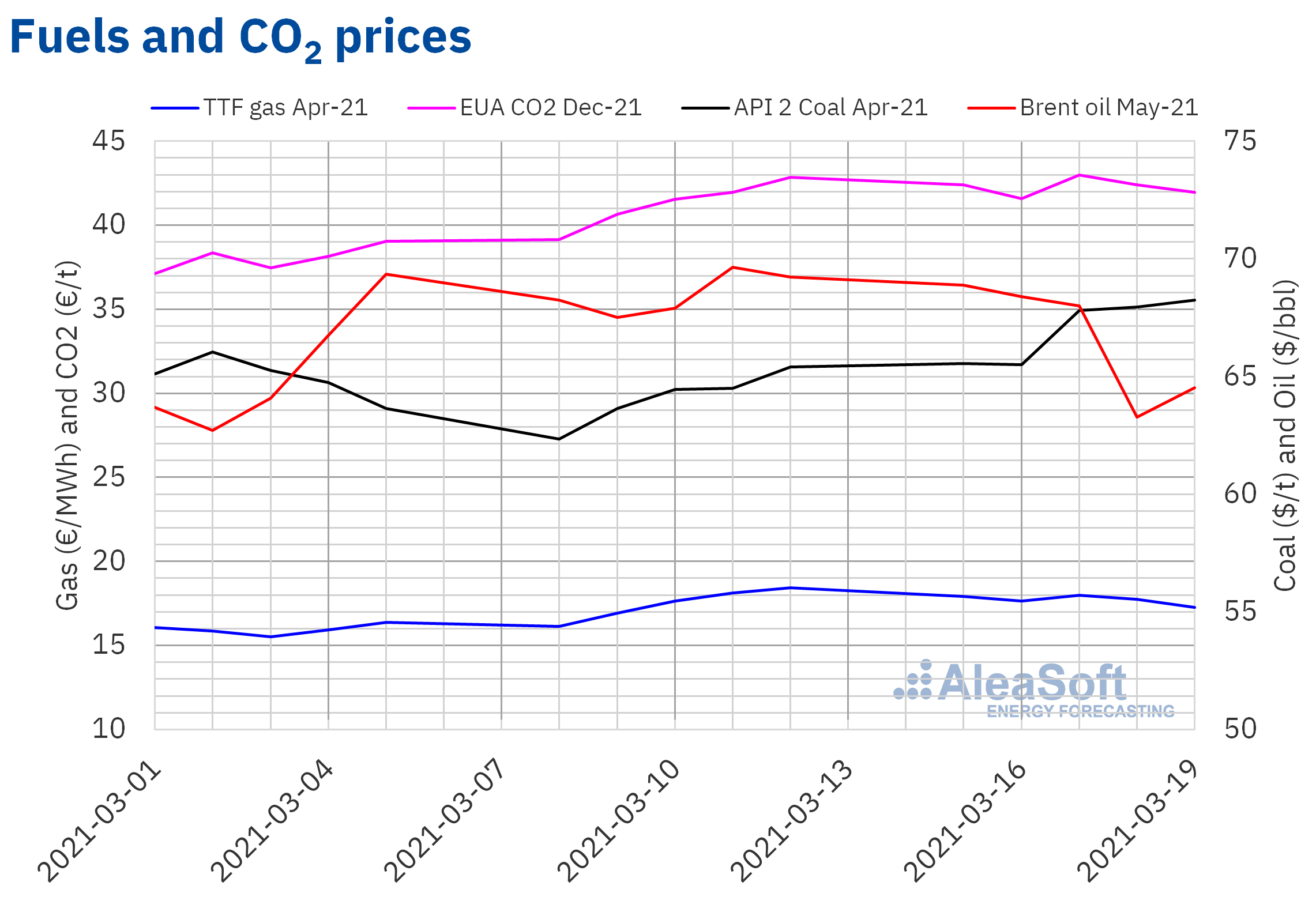

Brent, fuels and CO2

The Brent oil futures prices for the month of May 2021 in the ICE market, the first four days of the third week of March, fell until reaching a settlement price of $63.28/bbl on Thursday, March 18. This price was 9.1% lower than that of the previous Thursday. However, on Friday there was a slight recovery and the settlement price was $64.53/bbl.

The week of March 15, the evolution of the COVID‑19 pandemic in Europe continued to cause concern due to its effects on the recovery of the demand, given the possibility that the mobility restrictions would be lengthened or increased in some areas of the continent. This exerted a downward influence on the evolution of the prices. In addition, the crude oil reserves of the United States increased.

On the other hand, a Saudi Arabian refinery was attacked with drones last Friday, March 19, causing fears of possible supply interruptions. However, despite the fire caused, the Saudi Minister of Energy reported that this attack did not cause any casualties or have an impact on the oil supply.

As for the TTF gas futures in the ICE market for the month of April 2021, most of the third week of March, the prices fell. As a result, the settlement price of Friday, March 19, was €17.27/MWh, 6.4% lower than that of the previous Friday.

Regarding the settlement prices of the CO2 emission rights futures in the EEX market for the reference contract of December 2021, the third week of March, they remained above €41/t. During the week, the prices ranged between €41.59/t of Tuesday, March 16, and €42.98/t of Wednesday, March 17. This settlement price of Wednesday was 3.5% higher than that of the same day of the previous week and exceeded by €0.13/t the historical record reached on Friday, March 12.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets in the spring of 2021

On March 18, the webinar “Prospects for the energy markets in Europe. Spring 2021” was held at AleaSoft, in which speakers from EY (Ernst & Young) also participated. One of the issues that stood out in the webinar was the confirmation that Spain is the paradise of the renewable energy PPA in Europe, both in number of PPA signed and in their total volume. Other means of financing of renewable energy projects, the regulation of the energy sector in Spain and the business opportunities abroad, with information on the regions that offer the highest profitability, were also analysed.

The second part of this webinar will be held on April 15 with the collaboration of speakers from Axpo. On this occasion, the prospects for the energy markets in the medium and long term, the new players in the financial markets to absorb the demand for financing, given the avalanche of new renewable energy capacity that is expected, the taking of positions regarding the climate change of the major stakeholders worldwide and the corporate PPA as a solution for both the industry and the renewable energy developers will be analysed.

Previously at AleaSoft webinars were held with the participation of speakers from important companies of the energy sector, in which, in addition to monitoring the evolution of the energy markets, the different mechanisms for the Project Finance, the audits and the due diligences, among others, were discussed. These are the webinars of October 2020 with the participation of Deloitte, November 2020 with Vector Renewables, January 2021 with PwC Spain and February 2021 with Engie. A common element in all these webinars, which was also brought to light in the webinar with EY, is the need to have long‑term electricity markets prices forecasts with a horizon that covers the years of lifetime of the projects. AleaSoft offers hourly prices forecasts with a 30‑year horizon and with confidence bands, obtained with a scientifically‑based model with proven quality. These forecasts, as well as those for the short and mid term, represent an important component in the digitalisation processes for the automation of obtaining forecasts, the data analysis and the extraction of knowledge and market intelligence.

Source: AleaSoft Energy Forecasting.