Information elaborated by AleaSoft, a leading company in the development of price and consumption forecasting models of energy markets

February 8th 2016- During 2015, the major European electricity markets had disparate behaviours, with the exception of the third quarter, when a heat wave hit the continent and caused a generalized increase in prices compared to the same quarter of the previous year. In annual terms, the MIBEL market and the EPEX SPOT-France market registered price increases linked to a growth in electricity demand; while, in the markets EPEX SPOT-Phelix and N2EX there were falls related to a drop in fuel price for electricity generation and, in the case of Germany, to an increase in wind power production. The Italian IPEX market didn’t undergo significant interannual variations, also backed up by the low variability of wind and hydro generation, as well as of electricity consumption compared to the previous year.

Data sources: EPEX SPOT-France – EPEX SPOT, EPEX SPOT Phelix – EPEX SPOT, N2EX – NORD POOL, IPEX – GME, MIBEL – OMIE. The prices of the N2EX market are expressed in €/MWh, calculated from the original values in £/MWh.

In 2015, the MIBEL market price of Spain and Portugal rose considerably compared to the price of 2014. The increase in annual demand, together with the low wind and hydro production in Spain compared to the previous year, caused the average price for 2015 to be of 50.32 €/MWh for Spain and 50.43 €/MWh for Portugal, representing an interannual increase of 8.19 €/MWh and 8.57 €/MWh respectively. The month with the lowest price of the year was February, with an average price of 42.57 €/MWh for both countries, but still far from February 2014 where prices were of 17.12, €/MWh for Spain and 15.39 €/MWh for Portugal. The month with the highest price was July, with 59.55 €/MWh and 59.61 €/ MWh for Spain and Portugal, respectively; it was the month where there was a low wind and hydro production in Spain compared to the previous year, as well as a significant rise in electricity demand due to the heat wave. On the other hand, during 2015 no hour with a price 0 €/MWh was registered, which that hadn’t happened since 2008.

In the EPEX SPOT-France market the daily market price was of 38.48 €/MWh in 2015, 3.85 €/MWh more than in 2014. However, the increase was more drastic in the first and third quarter, with 7.15 €/MWh and 7.44 €/MWh respectively. In 2015 the price of 12.74% of the hours coincided with the MIBEL market price, of which 35% are subsequent to the interconnection between Spain and France set up on October 5th.

During 2015, the EPEX SPOT-Phelix market of Germany and Austria, with an average price of 31.76 €/ MWh, fell slightly by only 1.12 €/MWh compared to 2014. This decrease was more notable in the first half of the year, with a difference of 2.08 €/MWh compared to 2014. The only quarter in which the price rose, compared to the previous year, was the third, caused mostly by the heat wave. This rise was of 1.30 €/MWh.

In the British N2EX market the annual average price was of 40.43 £/MWh (55.72 €/MWh), falling by 1.67 £/MWh compared to 2014, due to the fall in price of the NBP gas, which is a reference in the country, as well as to a decline of 2.9% in demand compared to the previous year. The largest drop was registered in the fourth quarter compared to the same quarter of 2014, with 7.64 £/MWh. However, in the second and third quarter, the average price increased by 2.78 £/MWh and 2.72 £/MWh respectively compared to the same quarters of 2014. In the graphic these declines are not seen due to the fact that the euro fell by 11.04% against the pound, causing the annual average price to grow in 2015, measuring in euros.

For the IPEX Italian market, the price was located at 52.31 €/MWh in 2015, only 0.23 €/MWh higher than in 2014. This increase was mostly concentrated in the first half, with 0.37 €/MWh compared to the first half of 2014. The average monthly price was between 47.27 €/MWh and 55.66 €/MWh, with the exception of the price of July (due to the aforementioned heat wave), where price rose to 67.77 €/MWh exceeding by 21.35 €/MWh the same month of 2014.

AleaSoft’s price forecasting of electricity markets for the year 2016

AleaSoft foresees that in 2016 electricity price will decrease for the main European markets in a general way.

Prices of fuels for electricity generation

The average price of Brent crude oil fell sharply in 2015, falling by $ 46.63 compared to 2014. The “black gold” was quoted at 35,98 $/bbl, the minimum price since 2008. During all months of the year, the price was dramatically lower than in the same months of 2014, with a minimum difference of 24.22 $/bbl in December, and the maximum of 60 $/bbl in January. The fall of the price of Brent crude is mainly due to OPEC’s refusal to reduce oil production and to the fall in demand caused by the economic slowdown that China suffered, one of the world’s largest consumers of this product.

During 2015, coal CIF ARA, which is a reference in Europe, followed the same downward trend that it has had since 2013. With an average annual price of 56.34 $/t, it declined by 19.01 $/t compared to 2014. A further decline was registered in December, with a difference of 24.50 $/t with regards to the same month of the previous year.

The price of gas, both Zeebrugge gas and NBP gas declined persistently during 2015. While the price drop was constant, the average annual price does not reflect it compared to the previous year, as in 2014 the price suffered a sharp drop during the summer months. The average price of Zeebrugge gas in 2015 was of 19.83 €/MWh, just 1.12 €/MWh less than in 2014 and, in the case of NBP gas it was of 14.62 £/MWh, 2.50 £/ MWh less than in the previous year.

Data sources: CIF ARA – EEX, BRENT – EIA, ZEEBRUGGE- NetConnect Germany, NBP – ICE ENDEX.

The forecasting scenario for fuels used by AleaSoft foresees that the price of all fuels will be lower than in 2015.

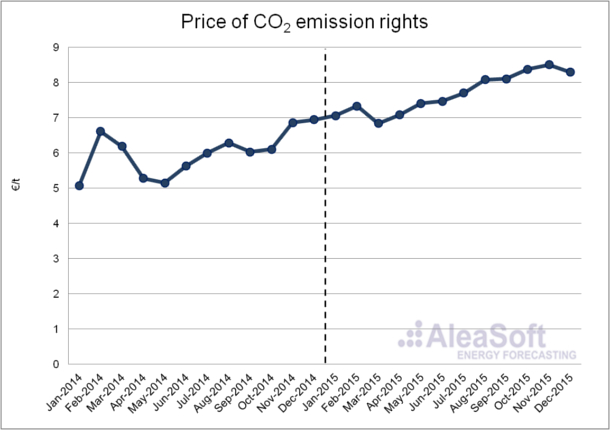

Prices of CO2 emission rights

The average price of CO2 emission rights has increased by 1.68 €/t compared to 2014 and stood at an average annual price of 7.69 €/t; with a clear upward trend, the average price in December reached 8.29 €/t. Aleasoft expects the price to decline compared to the end of 2015.

Data Sources: EEX.

Download PDF